Within this growing industry, there is an increasing amount of payment technology and insurance options. Of course, there are hurdles to overcome such as taxes and cross-border tariffs. This can be difficult to navigate especially since more information about this online is in Japanese.

This article will discuss the financial aspects of Japanese eCommerce such as payments, tax, insurance, and tariffs. So, if you want to sell your product in Japan with eCommerce, read about it here.

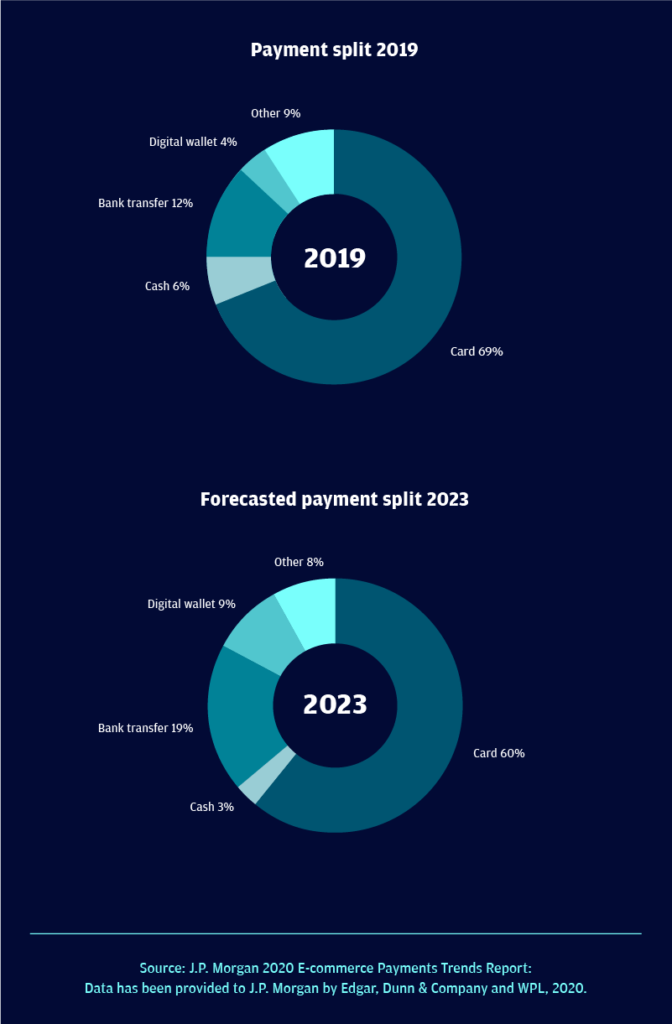

When paying for something online in Japan, there are few methods to pay. However, according to the research done by JP Morgan, paying by card is the most popular form of payment for online purchases. In addition to this, credit cards are favored over debit cards.

Different from other economies, cash is still dominant in physicals in Japan. This also extends to cash-on-delivery, where cash is a common payment. Konbini or Japanese convenience are prominent in Japanese society as they are popular among teens and older generations. With hygiene concerns from COVID-19, the cash payment method is expected to shrink by 2023.

With the rise of digital wallets, major Japanese eCommerce brands are launching wallets such as Rakuten Pay. However, this new method of payment has a long way to go in some other markets to beat physical card payments.

Having insurance is required in an eCommerce business because of the risk of mistakes such as selling incorrect items or damaging inventory and property. Here are some of the reasons why you need insurance:

- Local Japanese platforms like Rakuten might require you to have insurance products such as worker’s compensation

- Hiring employees

- Car insurance is required if you’re using a car for fulfilling purchases yourself for example

- Repairing or replacing property such as protecting your inventory, equipment, and buildings if an accident occurs

To choose the right insurance, it’s important to reach out and ask for advice from major eCommerce platforms that are willing to offer it.

Cross-border Taxation & Tariffs

The purpose of cross-border eCommerce is to sell and move products from one country to another. When this happens, it’s important to know about tax, value-added tax, and tariff implications that may apply.

Luckily, websites such as U.S.-Japan Trade Agreement Negotiations (the US specific) and Trade with Japan (the UK specific) are useful to understand all this.

Similarly, with insurance, major Japanese eCommerce platforms will offer advice on how to effectively navigate through this.

Finding the right eCommerce partner

This is necessary since you might be working with local distributors and agencies to start selling in Japan.

Organizations such as the Department for International Trade Japan and Japan’s METI can help you find these partnerships.