The Ministry of Economy, Trade, and Industry (METI) conducted the “FY2020 Industrial Economy Research Commission Project (Market Survey on Electronic Commerce)” to analyze and summarize the current status of the Japanese e-commerce (EC) market.

Here we complied and summarized the results.

Read our article about B2C and B2B e-Commerce in Japan!

Summary of Survey Results

Domestic e-commerce market size

(BTOC AND BTOB)

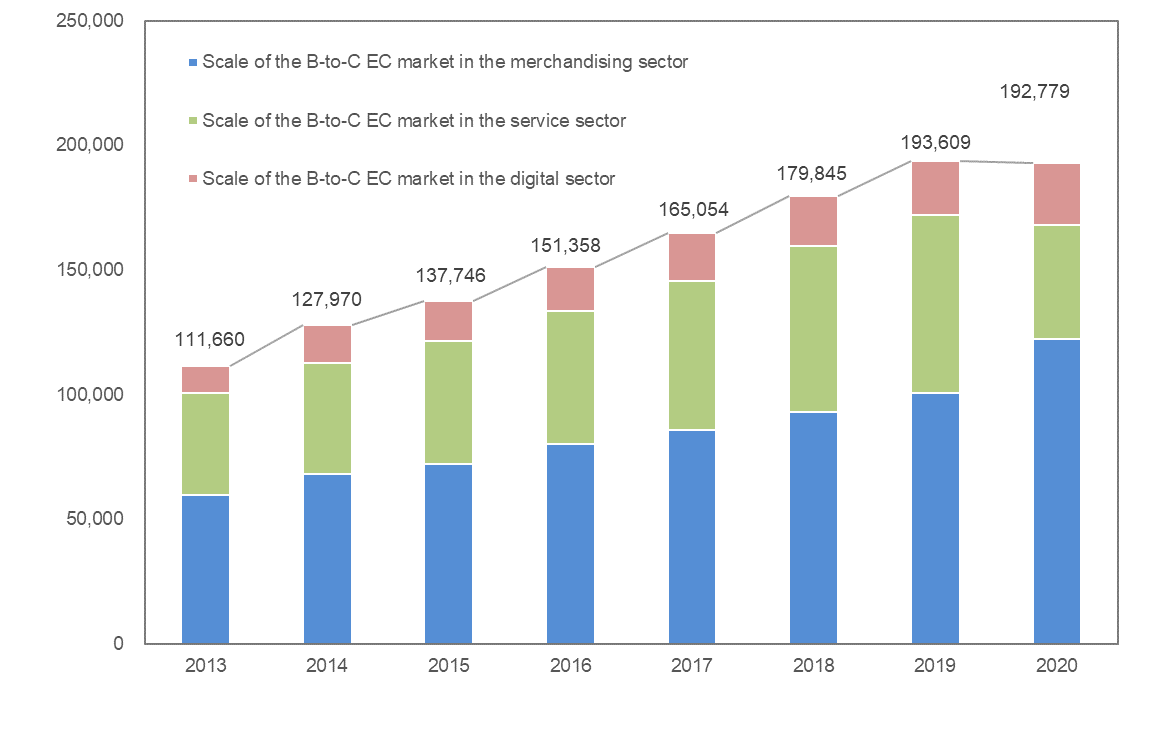

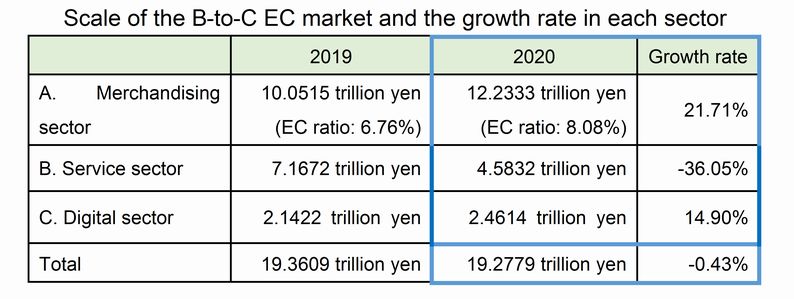

In 2020, the B2C EC market (consumer e-commerce) in Japan was 19.3 trillion yen (down by 0.43% from 19.4 trillion yen in the previous year). In addition, B2B EC (business-to-business e-commerce) market in Japan has decreased to 334.9 trillion yen (down by 5.1% from 353.0 trillion yen in the previous year).

As a countermeasure against the spread of the new coronavirus, there has been an increase of staying home and use of EC which resulted in a significant market expansion in the merchandising sector. On the other hand, the market scale in the service sector decreased significantly, mainly due to shrinkage experienced by travel services. As a result, the significant growth in the merchandising sector was offset by a significant decrease in the service sector, and the scale of the B2C EC market as a whole decreased by 83 billion yen. This was the first time that the B-to-C EC market did not increase since the beginning of this market survey.

Meanwhile, the EC conversion rate is on the rise, at 8.08% for B2C EC (up 1.32 points from the previous year) and 33.5% for B2B EC (up 1.8 points from the previous year), indicating continued progress in the digitization of business transactions.

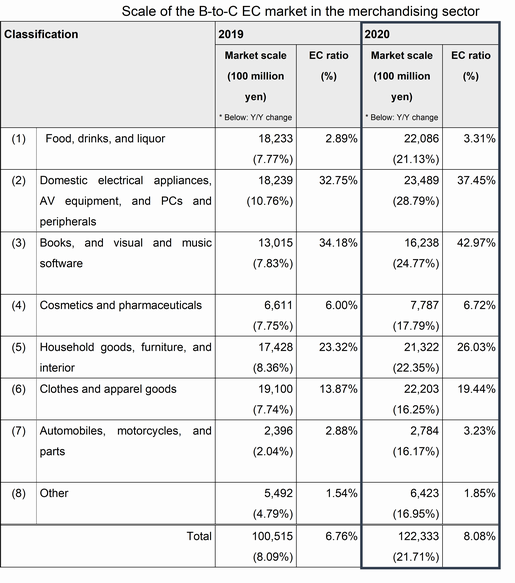

Merchandising / Product Sales Sector

A breakdown of the B2C EC market size in the goods sales field shows that “household appliances, audio/visual equipment, PCs, peripherals, etc.” at 2,348.9 billion/trillion yen, “clothing and accessories” at 2.22 trillion yen, “food, beverages and liquor” at 2.21 trillion yen and “household sundries, furniture, and interior” at 2.13 trillion yen accounts for these large shares. These top four categories together account for 73% of the goods sales sector. In addition, the market size has expanded significantly in all categories due to the impact of the coronavirus infection.

A breakdown of the B2C EC market size in the goods sales field shows that “household appliances, audio/visual equipment, PCs, peripherals, etc.” at 2,348.9 billion/trillion yen, “clothing and accessories” at 2.22 trillion yen, “food, beverages and liquor” at 2.21 trillion yen and “household sundries, furniture, and interior” at 2.13 trillion yen accounts for these large shares. These top four categories together account for 73% of the goods sales sector. In addition, the market size has expanded significantly in all categories due to the impact of the coronavirus infection.

The EC ratios were high for “books, visual, and music software” at 42.97%, “domestic electrical appliances, AV equipment, and PCs and peripherals” at 37.45%, and “household goods, furniture, and interior” at 26.03%. These are highly compatible with EC. For example, “household appliances, audio/visual equipment, PC/peripherals, etc.” has a high affinity with EC because of their clear product specifications and easy-to-understand contents and features by researching (searching on the internet for) them in advance. “Furniture and interior goods” are also highly compatible with EC, as they are detailed for any size and color according to each household’s circumstances and have no restrictions on sales space or inventory.

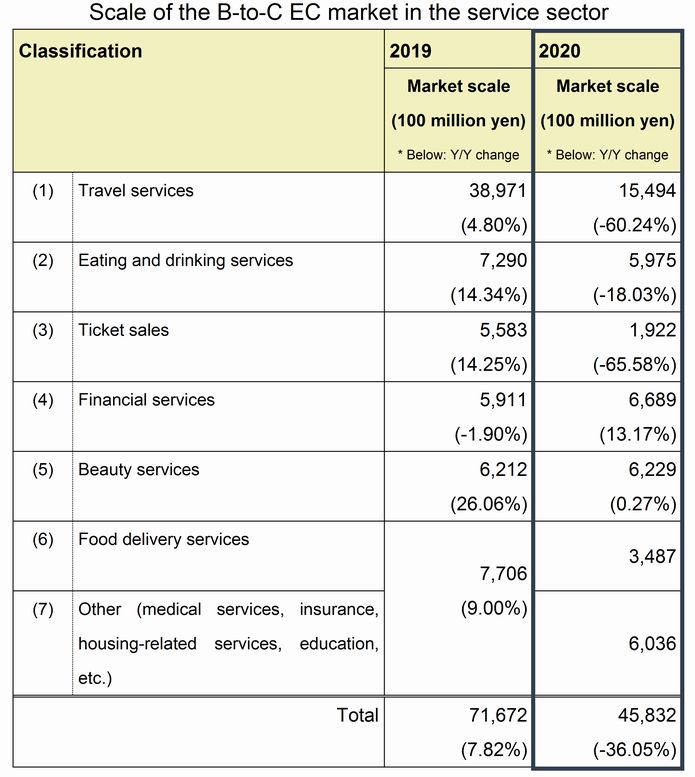

Service-Related Sector

Breaking down the B2C EC market size in this field, “travel services” at 1.55 trillion yen accounts for the largest share. In addition, the market size of “travel services,” “food & beverage services,” and “ticket sales” have significantly shrunk due to the coronavirus.

Breaking down the B2C EC market size in this field, “travel services” at 1.55 trillion yen accounts for the largest share. In addition, the market size of “travel services,” “food & beverage services,” and “ticket sales” have significantly shrunk due to the coronavirus.

The market size table of B2C EC in the service sector is to the right.

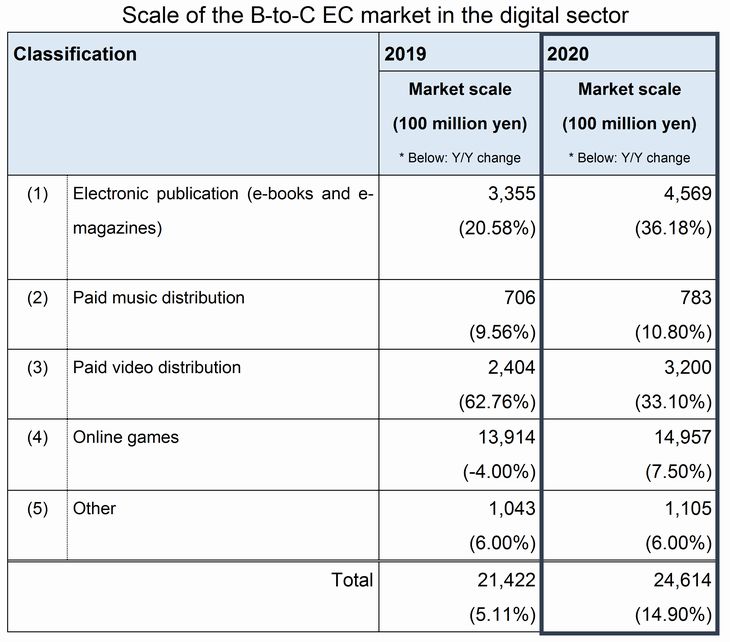

Digital Sector Sector

In the digital sector, “online games” (1.49 trillion yen) accounted for the largest share. COVID 19 has to lead to the expansion of the “online game,” “pay video distribution,” and “pay music distribution” markets. This has caused more consumers to stay home and increased demand for stay-home services.

In the digital sector, “online games” (1.49 trillion yen) accounted for the largest share. COVID 19 has to lead to the expansion of the “online game,” “pay video distribution,” and “pay music distribution” markets. This has caused more consumers to stay home and increased demand for stay-home services.

Size of the B2C-EC market in the digital field (table to the left).

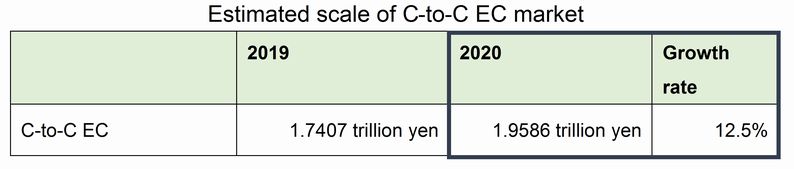

Domestic e-commerce market size (CtoC)

In recent years, the C2C EC market has been expanding since 2008. The METI has estimated the scale of the market in Japan since the 2016 survey. The scale of the C2C EC market in 2020 is estimated to be 1.96 trillion yen (up by 12.5% from the previous year). As with the B2C EC market, one of the reasons behind the market scale expansion is that users of C2C EC increased staying home and using EC to combat the COVID-19 pandemic causing the merchandising sector’s EC market to expand.

Estimated CtoC-EC market size table is below.

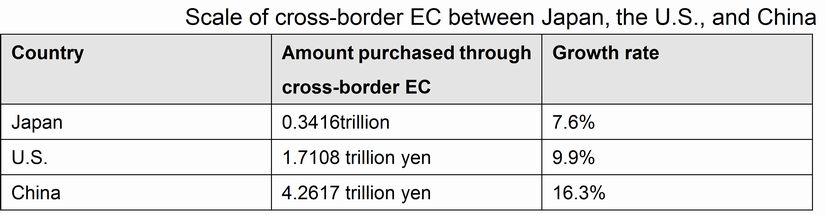

Cross-border EC Market Size (Japan, the U.S., and China)

In 2020, the market scale of cross-border EC between Japan, the U.S., and China, increased in all three countries. In particular, the amount purchased through cross-border EC by Chinese consumers was 1.95 trillion yen from Japanese business operators (up by 17.8% from the previous year) and 2.31 trillion yen from U.S. business operators (up by 15.1% from the previous year) and continuing the previous year’s increasing trends.

A cross-border table of the EC market size in Japan, the U.S., and China is below.

Outline of the E-Commerce Market Survey

This is the 23rd annual survey of e-commerce market trends and actual user conditions, conducted since 1998. In addition to the market scale of B2C EC, B2B EC, and C2C EC in Japan, the survey also examines consumer market trends in cross-border EC between Japan, the U.S., and China.

For the full report, please click here.