In this article, we will explain the growth rate trends of the Japanese EC market. Please read this article to the end if you are already involved in the EC industry or if you are planning to enter the industry in the future.

table of content

What is the EC Market?

EC Market Size, Transition, and Growth Rate in Japan in 2021

Will it Still Grow? Future Growth Forecast of EC Market and Benefits of E-Commerce

Rapidly Growing Cross-Border EC; The State of E-Commerce Around the World

EC Market Sales Ranking

Sales Ranking of Domestic E-Commerce Sites

Summary

In the first place, EC is Japanese-made English, which is an abbreviation for Electronic Commerce in English. The term “electronic commerce” refers to all transactions in which orders are placed and received over an Internet connection.

There are two definitions of EC: broad and narrow.

EC in a broad sense includes VAN / dedicated and conventional EDI that does not use the TCP / IP protocol. On the other hand, EC in a narrow sense is a transaction that is established in a computer network system that uses the Internet even in a line

EC is further classified into three types.

- “BtoB EC“ (Business to Business): Refers to transactions between companies. The commercial materials include raw materials, parts, and equipment.

- “BtoC-EC“ (Business to Consumer)”: Refers to transactions between companies, stores, brands, and consumers. Mall ECs such as Amazon, Rakuten Ichiba, and other commonly imagined online shops are included in this category.

- “CtoC EC” (Consumer to Consumer)”: Refers to transactions between consumers. Examples include flea market apps such as Mercari and Rakuma and online auctions.

Another word that you often see with EC is “e-commerce.” Like “EC,” “e-commerce” is an abbreviation of “Electronic Commerce. The definitions of the two are not particularly distinct.

However, the word “EC or e-commerce site”, which refers to online shops, corresponds to EC in a narrow sense. Therefore, we consider EC sites to be included in e-commerce and EC.

Nowadays, we often hear such phrases as “The EC market is expanding year by year! The future is the age of EC” and so on. But what is the actual situation?

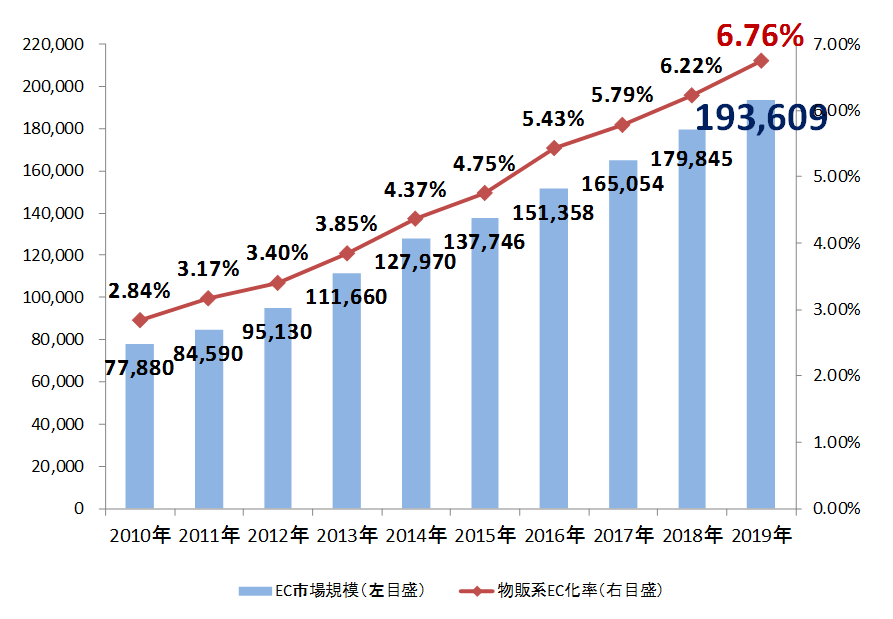

Let’s take a look at the latest domestic EC market from the data released by the Ministry of Economy, Trade, and Industry in July 2021.

The BtoC-EC market, represented by EC malls such as Amazon and Rakuten Ichiba and online shops, has been expanding for the ninth consecutive year. The growth rate is also increasing every year.

An online shop where you can shop “anytime, anywhere” matches the diversifying lives of consumers. The number of new entrants is increasing, and competition in the market is also intensifying year by year.

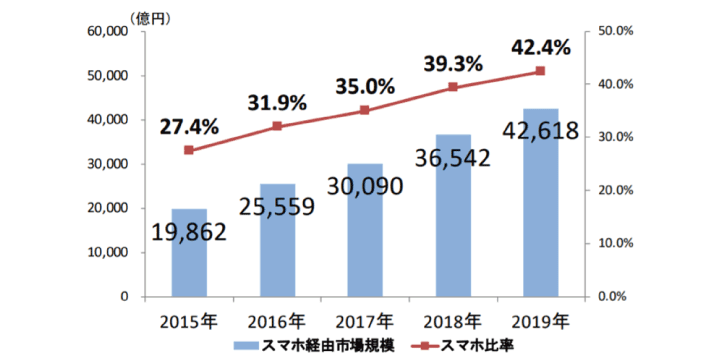

Among the people involved in buying and selling in the EC market, the percentage of people who use smartphones instead of PCs is increasing year by year.

The graph below shows the changes in the market size via smartphones over the last five years from the “International Economic Research Project (Market Research on Electronic Commerce) on the Economic Growth Strategy of the First Year of Reiwa” published by the Ministry of Economy, Trade, and Industry (METI).

While the percentage of users via smartphones was less than 30% in 2015, it is close to half by 2019.

The reasons for this growth are the convenience of smartphone apps and the development of marketing measures using smartphones (SNS, push notifications, etc.). In addition to this, the number of smartphone users, regardless of generation, is increasing.

2018 | 2019 | Growth rate | |

Product Sales field | 9.3 trillion yen (EC conversion rate 6.22%) | 10.05 trillion yen (EC rate 6.76%) | 8.09% |

Service Fields | 6.65 trillion yen | 7.17 trillion yen | 7.82% |

Digital field | 2.04 trillion yen | 2.14 trillion yen | 5.11% |

Total | 17.98 trillion yen | 19.36 trillion yen | 7.65% |

Source: Summarized the results of market research on e-commerce

Next, let’s take a look at the data for each of the three fields: product sales, services, and digital. The market size of each field is shown in the table above.

All three fields are expanding, with the highest growth rate being in product sales e-commerce. In the sales industry, marketing that utilizes both real (real stores) and online (EC) such as O2O and omnichannel has been conspicuous in recent years, and the number of new stores entering EC is increasing.

Among EC product sales, the category with the highest growth rate from last year was “household appliances, audio/visual equipment, and PC/peripheral equipment, etc.”. This category accounted for 1.82 trillion yen, 110.76% of last year’s total, and the EC rate for the market as a whole was also high at 32.75%.

In addition, “food, beverages, alcoholic beverages” at 1.82 trillion yen, “books, video/music software” at 1.30 trillion yen, “life miscellaneous goods, furniture, interiors” at 1.74 trillion yen, and “clothing and accessories, etc.” at 1.91 trillion yen.

Category | Elongation Rate |

Food and confectionery | 173.86% |

Kids / Baby / Maternity | 171.06% |

Toys, Hobby & Game | 165.01% |

Looking at stores on the e-commerce site building service MakeShop, the largest growth rates from 2019 to 2020 were in “food and confectionery,” “kids, baby, and maternity,” and “toys, hobbies, and games.

This can be attributed to the changing lifestyles of the coronavirus. This is probably because the number of people buying groceries on EC sites has increased due to the self-restraint of restaurants and shortened business hours. It is also assumed that demand for kids’ products and toys increased as people spent more time with their families.

(Compare the distribution value from January 1 to September 30, 2019, and January 1 to September 30, 2020, for each product category.

The EC market is showing remarkable growth in various fields, but the rate of EC conversion to the entire market is only 6.76% even for product sales EC, which is showing a remarkable expansion trend.

By global standards, for example, the EC rate in the U.S. is expected to reach 13.6% by 2021, so there is still room for growth in the future.

As for data, the Nomura Research Institute’s “IT Navigator 2020,” published in 2019, calculates that the EC market will be worth 27.8 trillion yen in 2025.

Furthermore, the omnichannel commerce market, which includes physical stores, is expected to increase from 54.4 trillion yen in 2018 to 80.6 trillion yen in 2025. In 2020, the coronavirus caused major changes in the economic activities of the society as a whole, including voluntary restraint from going out and shorter hours at retail stores and restaurants. In such a situation, online shopping became the mainstay for both consumers who could not go out and businesses that could not open their stores. The number of businesses opening new stores increased, providing an unexpected tailwind for the shift to e-commerce.

EC sales have less fixed costs such as rent than physical stores and can be started at a lower risk. It also has many advantages, such as the ability to expand sales channels without time and location constraints, and the ability to send customers to actual stores.

As mentioned above, the growth rate of the global EC market is even greater than in Japan. As of 2018, the global EC market size is 313 trillion yen. That was 123.3% compared to last year.

The Asia-Pacific region accounts for a particularly large share of the total, at 61% total, or 190 trillion yen. By country, China leads the way, followed by the United States and the United Kingdom, with China accounting for about 52% of the EC market.

Country | Cross-border EC purchase amount | Growth rate |

Japan | 317.5 billion yen | 14.8% |

USA | 1.557 trillion yen | 11.8% |

China | 3.665 trillion yen | 12.3% |

Source: Summarized the results of market research on e-commerce

Another trend that should not be overlooked is the rise of cross-border EC. The table above shows data on the value of cross-border EC purchases and growth rates for Japan, the U.S., and China in FY2019.

In the BtoC-EC market, China and the U.S. are the two main trading partners of Japan. In particular, the transaction value with China is growing remarkably year by year. The number of businesses in Japan that challenge cross-border EC is increasing every year.

Cross-border e-commerce has the advantage of expanding sales channels, as it requires less investment than setting up a physical store outside of Japan, and allows you to promote your products and services to overseas consumers.

Furthermore, if you have a physical store in Japan, it will also appeal to tourists visiting Japan.

Ranking | Name | Amount of Sales |

1st place | Rakuten | 3.9 trillion yen |

2nd place | Amazon Japan | 3.42 trillion yen (estimated) |

3rd place | Yahoo! Shopping | 890 billion |

Let’s look at the figures from EC malls, which are well-known and have large transaction amounts. (Based on in-house research using information from each company’s website and IR, etc., as of October 2020)

Rakuten (Rakuten Ichiba) is prominent and is a long-established company in Japan

The company’s popularity is supported by measures to increase the sense of savings for users, such as shopping campaigns and high point redemption rates. The company also established strong links with other services within the group, such as Rakuten Card and Rakuten Travel, and has succeeded in retaining users.

In second place is Amazon Japan, a major marketplace-type mall. Amazon Prime, a subscription service that allows unlimited use of express delivery and delivery date/time delivery, and video delivery services, is popular.

* The following article provides an estimate of Amazon’s distribution value.

“For Amazon’s sales, the total value is the sum of Amazon as a seller and a commission of about 10% for third-party sellers in Japan, [……] and the marketplace’s share is expected to continue to grow. Therefore, we estimate the 2019 percentage to be 55%. Based on this, we estimate that the total distribution in 2019 will be 3,423.8 billion yen [……].”

Last but not least is Yahoo!Shopping. Along with Rakuten and Amazon, positioned as the top three in Japan.

Yahoo! Shopping, LOHACO, Charm, PayPay Mall, and ZOZO (excluding the ZOZOTOWN flagship store) totaled 890.1 billion yen in FY2019.

Softbank Group, the parent company of Yahoo! Shopping, should not be overlooked in reading Yahoo! Shopping’s sales trends. In September 2019, it acquired the major fashion e-commerce company ZOZO. This was followed by the announcement of a business merger with LINE at the end of 2019. It is inevitable to pay attention to how these moves will affect the EC market as a whole.

Ranking | Name | Amount of Sales |

First place | Amazon Japan | 1.744 trillion yen |

2nd place | Yodobashi Camera | 138.6 billion yen |

3rd place | ZOZO | 125.5 billion yen |

Next, let’s look at the sales ranking of domestic EC sites along with their numbers.

Marketplace-type Amazon is often counted as a stand-alone EC site. Following the ranking of mall-type EC, Amazon also showed a large presence here.

The e-commerce site of Yodobashi Camera, an consumer/electronics retailer, is the second largest e-commerce site in Japan. Yodobashi Extreme” features free shipping at any price, same-day delivery of orders with no additional fees, and delivery of products within 2.5 hours at the shortest, and the strength of its logistics infrastructure has been well received.

Like Amzon, ZOZOTOWN is also ranked here because it is a marketplace-type company, and it has been making some changes every year, such as opening stores in PayPay malls, which has contributed to the expansion of its customer base.

More than 20 years have passed since the opening of Rakuten Ichiba in 1997.

The scale of the market is still expanding. It is not limited to the sale of goods, but has also diversified into other forms, such as the rise of video and music subscription distribution services and online reservation sites for travel and restaurants.

Behind this trend lies the transformation of economic activities in society as a whole and the diversification of consumption styles themselves.

After 2020, demand for e-commerce is has grow even more because of the corona virus. Keep a close eye on market trends both domestically and internationally.